The Economic Index for the U.S. is Predicted to Begin 2020 with Slow Economic Growth

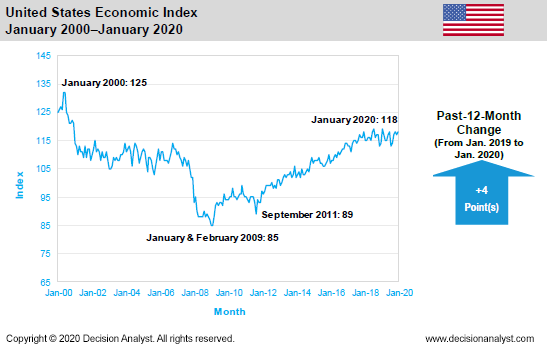

The Decision Analyst U.S. Economic Index stood at 118 in January 2020, a modest year-over-year increase of 4 points. A look at the graph below shows that the U.S. Economic Index has been relatively flat over the past 18 months, a pattern that suggests slowing economic growth rates in 2020. A real GDP growth rate in the 1.5% to 2.0% range is most likely in 2020, based on the latest evidence. The Economic Index tends to lead overall U.S. economic activity by 6 to 12 months. Below is a 20-year history of the U.S. Economic Index.

“A quick look at the Economic Index above shows the Index has been basically flat for the past 6 or 7 quarters,” said Jerry W. Thomas, President/CEO of Decision Analyst. “U.S. consumers are doing their part to keep the economy strong. They have increased their borrowing so that they can continue to spend money. The government has massively stimulated the economy through low interest rates and deficit spending, an effort that cannot be long sustained. U.S. corporations, however, are laggards. They are not investing in new factories and new products, as was hoped when the tax cut went into effect in 2018. Instead, major corporations have used most of the tax cuts to buy back their stocks, a poor way to spend the extra money and a short-term ‘artificial’ stimulus to stock markets. In addition to low levels of corporate investment, the continuing trade disputes and tariffs are having a negative effect on the U.S. economy as well. The coronavirus is also slowing economic activity worldwide, but hopefully the virus will run its course in a few months. Slowing economic growth in Europe, China and Mexico poses added risks for the U.S. economy,” said Thomas.

Census Divisions

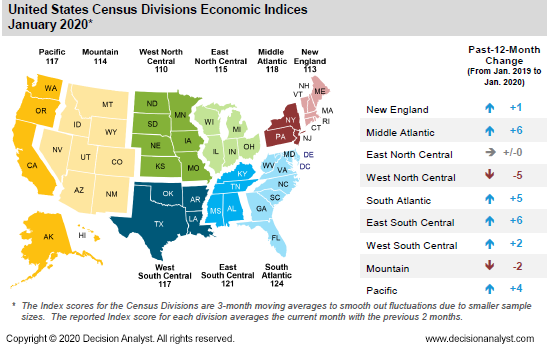

Two of the U.S. Census Divisions saw declines in the past 12 months, while most others increased. The Middle Atlantic and East South Central Census Divisions each increased 6 points and the South Atlantic Census Division increased by 5 points. Meanwhile, the West North Central Census Division declined by 5 points, and the Mountain Census Division declined by 2 points. The following charts are 3-month moving averages, so the numbers are lower than the overall Economic Index (that is, the time periods covered are slightly different). This differential will correct itself over time.

Global Index

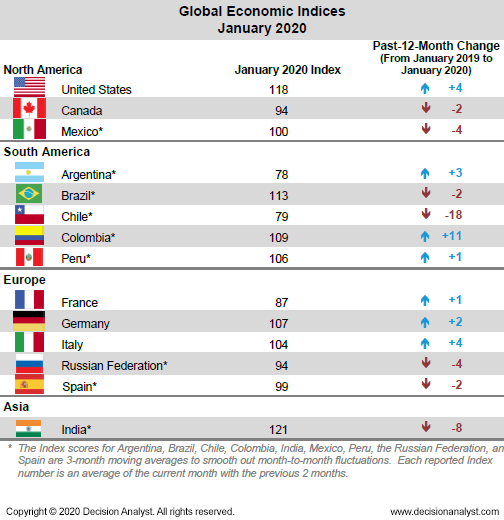

The following chart compares the U.S. Economic Index to Decision Analyst’s Economic Indices for other countries. In North America, both Canada and Mexico saw declines in the past 12 months. Mexico decreased by 4 points, while Canada decreased by 2 points. In South America, Colombia increased by 11 points, while Chile dropped by 18 points, and Brazil declined by 2 points. In Europe, Italy increased by 4 points, yet the Russian Federation declined by 4 points and Spain declined by 2 points. Globally, many economies are increasingly at risk of slow growth and/or recession. Some of the major countries tracked by Decision Analyst are shown below.

Methodology

The Decision Analyst Economic Index is based on a monthly online survey of several thousand households balanced by gender, age, and geography. The scientific survey is conducted in the last 10 days of each month. The Economic Index is calculated from 9 different economic measurements using a sophisticated econometric model. The result is a snapshot of coming economic activity in each country surveyed, as seen through the eyes of representative consumers living in the respective countries.

Decision Analyst conducts its concurrent economic surveys each month in Argentina, Brazil, Canada, Chile, Colombia, France, Germany, India, Italy, Mexico, Peru, the Russian Federation, Spain, and the United States. Whenever the Decision Analyst Economic Index is greater than 110, it tends to signal an expanding economy. An Index value of 90 to 110 suggests a no-growth or slow-growth economy, and near or below 90 generally indicates economic contraction. These guidelines vary by country, however.

About Decision Analyst

Decision Analyst (www.decisionanalyst.com) is a global marketing research and analytical consulting firm specializing in strategy research, new product development, advertising testing, and advanced modeling for marketing decision optimization. For over 40 years, the firm has delivered competitive advantage to clients throughout the world in consumer-packaged goods, telecommunications, retail, technology, medical, and automotive industries.

Media Contact

Cristi Allen

Publicity

Email: callen@decisionanalyst.com

Phone: 1-800-ANALYSIS (262-5974) or 1-817-640-6166

Address: 604 Avenue H East

Arlington, TX 76011

Library

Interactive Economic Index

Click on the map above to open Decision Analyst's Interactive Map for the United States and its nine census divisions.

Logos & Images

If you are doing a story on Decision Analyst or using any of our published data, news releases or articles, you must cite "Decision Analyst" as the source of the information.

If you use any of the charts or tables from the press releases or other published materials, please email Cristi Allen at callen@decisionanalyst.com to let us know which graphics you took and for what newspaper, magazine, or website it was used.